Non cloud-based accounting software runs directly on a computer or server without internet dependency. It offers control and security for sensitive financial data.

Non cloud-based accounting software, also known as desktop accounting software, provides businesses with a stable and secure platform for managing financial transactions. This software ensures data privacy by storing information locally, reducing the risk of online breaches. It is ideal for companies that require robust, offline access to their financial records.

Users can manage accounts, generate reports, and perform complex calculations without relying on an internet connection. Despite the rise of cloud solutions, non cloud-based software remains a viable option for those prioritizing data control and security. It offers a reliable alternative for small businesses and enterprises alike.

Introduction To Non-cloud Accounting Software

Non-cloud accounting software operates offline. It is installed directly on a computer. This software does not rely on the internet for functionality. Many businesses still prefer this traditional method. They value control, security, and independence.

The Resilience Of Traditional Solutions

Non-cloud solutions remain relevant today. They offer reliability without internet dependency. Many firms trust these systems due to their robustness. These tools continue to serve countless businesses effectively.

Key Features And Benefits

Non-cloud accounting software offers several advantages. Here are some key features and benefits:

- Data Security: Data is stored locally, reducing online threats.

- Access Control: Only authorized personnel can access the software.

- Cost Efficiency: No recurring subscription fees.

- Offline Accessibility: Operates without needing an internet connection.

- Customization: Can be tailored to specific business needs.

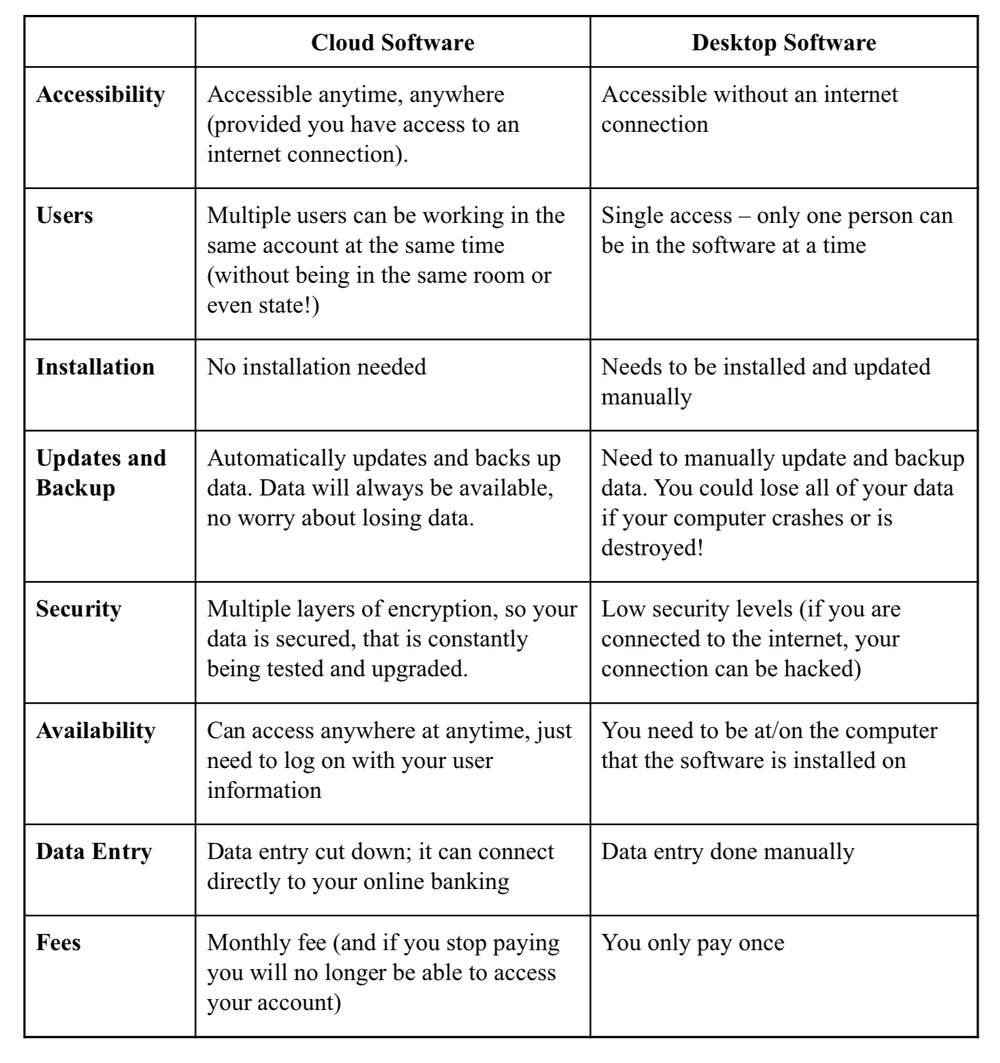

Let’s see a comparison between cloud and non-cloud solutions:

| Feature | Non-Cloud Software | Cloud Software |

|---|---|---|

| Data Storage | Local | Remote |

| Internet Dependency | None | Required |

| Cost | One-time | Recurring |

| Security | High (Local) | Variable |

| Customization | High | Limited |

The Rise Of Non-cloud Solutions

The rise of non-cloud solutions is a fascinating trend in accounting software. These tools offer unique advantages over their cloud-based counterparts. Companies are rediscovering the benefits of local, non-cloud accounting software. Let’s explore why non-cloud solutions are gaining traction.

Historical Context

Before cloud computing, businesses relied on on-premise accounting software. These systems operated on local servers within the company. They provided complete control over data and security. In the 1990s, many companies adopted non-cloud accounting solutions. These systems were the backbone of financial operations.

Back then, the software was often more customizable. Companies could tailor the software to fit their needs precisely. This level of customization is less common with cloud-based solutions.

Modern Relevance

Today, many businesses still use non-cloud accounting software. These tools offer several modern advantages. Data security remains a top concern. Local software ensures data stays within the company’s premises. This reduces the risk of data breaches.

Non-cloud solutions also provide more control over software updates. Businesses can decide when to update their systems. This flexibility is crucial for companies with specific operational requirements.

Another benefit is offline accessibility. Non-cloud software doesn’t rely on internet connections. This ensures continuous access to financial data.

| Feature | Non-Cloud Solutions | Cloud Solutions |

|---|---|---|

| Data Control | High | Moderate |

| Security | Local | Remote |

| Customization | Extensive | Limited |

| Offline Access | Yes | No |

In summary, non-cloud accounting software offers distinct advantages. Businesses gain control, security, and flexibility. These features make non-cloud solutions relevant today.

Comparing Cloud And Non-cloud Software

Choosing between cloud and non-cloud accounting software can be challenging. Each has its pros and cons. Let’s explore the differences to help you make an informed decision.

Security Considerations

Security is a top priority for any business. Non-cloud software is usually stored on local servers. This means you have more control over security measures. You can implement strong firewalls and antivirus programs.

Cloud software stores data on remote servers. This can be risky if the cloud provider has weak security. Hackers may target these servers. Yet, reputable cloud providers offer robust security features. These include encryption and regular security updates.

Accessibility And Control

Non-cloud software offers greater control. You decide who can access the data. You also control how and when updates are applied. This can be ideal for businesses with strict regulatory requirements.

Cloud software excels in accessibility. You can access it from anywhere with an internet connection. This is great for remote teams. But, it requires a stable internet connection. Without it, accessing data can be problematic.

Cost Implications

Cost is a key factor in choosing software. Non-cloud software usually involves a one-time purchase. You might also pay for annual maintenance and updates. This can be costly upfront but cheaper in the long run.

Cloud software often uses a subscription model. You pay monthly or yearly fees. This can be more budget-friendly initially. But, costs can add up over time. Here’s a quick comparison:

| Non-Cloud Software | Cloud Software |

|---|---|

| One-time purchase | Subscription-based |

| Annual maintenance fees | Monthly or yearly fees |

| Long-term savings | Ongoing costs |

Credit: www.researchgate.net

Top Non-cloud Accounting Software Gems

Not all businesses prefer cloud-based solutions. Some need reliable non-cloud accounting software. Here are some top non-cloud accounting software gems that can meet your needs.

Software A: Feature Highlights

Software A stands out due to its amazing features.

- Comprehensive Reporting: Get detailed financial reports easily.

- Inventory Management: Track stock levels and orders efficiently.

- Multi-User Access: Allow multiple users to access the software.

- Secure Data: Keep your financial data safe and secure.

Software B: Customization And Flexibility

Software B offers excellent customization options and flexibility.

| Feature | Details |

|---|---|

| Custom Invoices | Create invoices that match your brand. |

| Flexible Reports | Generate reports that fit your needs. |

| Scalable Solutions | Adjust the software as your business grows. |

Software C: User Experience And Support

Software C excels in user experience and support.

- Intuitive Interface: Easy to navigate and use.

- 24/7 Support: Get help anytime you need it.

- Training Resources: Access tutorials and guides.

- Community Forums: Engage with other users and experts.

Installation And Maintenance

Using non-cloud based accounting software requires attention to installation and maintenance. This ensures smooth operation and minimizes disruptions. Let’s dive into the process of setting up and managing this type of software.

Initial Setup

The initial setup involves several important steps. Here’s a simple guide:

- System Requirements: Ensure your computer meets the software’s requirements.

- Software Installation: Insert the installation CD or download the software.

- Configuration: Follow on-screen prompts to complete the setup.

- Security Settings: Configure user permissions and security settings.

Completing these steps ensures a smooth start with your accounting software.

Ongoing Management

Managing the software involves regular maintenance tasks to keep it running efficiently. Key tasks include:

- Regular Updates: Install updates to fix bugs and improve performance.

- Data Backup: Schedule regular backups to prevent data loss.

- System Health Checks: Run diagnostic tools to ensure system stability.

- Security Audits: Regularly review and update security settings.

These tasks help maintain your software and protect your data.

Data Security And Privacy

Data security and privacy are critical aspects of accounting software. Non cloud based accounting software offers unique advantages in this area. Let’s dive into how it ensures the safety of your sensitive data.

Protecting Sensitive Information

Non cloud based accounting software stores data on local machines. This minimizes exposure to online threats. Sensitive information is not exposed to the internet. You control the physical access to your data.

Data encryption is often a standard feature. It ensures that even if data is accessed, it remains unreadable. Only authorized personnel can decode and read the data. This adds an extra layer of protection.

Compliance With Regulations

Non cloud based accounting software helps in meeting compliance requirements. Many industries have strict data privacy regulations. Storing data locally makes it easier to follow these rules.

Audits become simpler with local data storage. You can quickly provide the necessary documentation. This helps in passing regulatory checks without hassle.

| Feature | Benefit |

|---|---|

| Local Storage | Reduces online exposure |

| Data Encryption | Protects sensitive information |

| Compliance | Meets regulatory requirements |

Non cloud based accounting software provides robust data security. It offers peace of mind that your sensitive information is protected. Meeting regulatory requirements becomes easier. This makes it a strong choice for businesses focused on data privacy.

Integration Capabilities

Integration capabilities are essential for any non cloud-based accounting software. They help streamline operations, enhance functionality, and ensure seamless data flow across various systems. In this section, we will explore the integration capabilities of non cloud-based accounting software, focusing on connecting with other systems and extending functionality through add-ons.

Connecting With Other Systems

Non cloud-based accounting software can connect with various other systems. This helps in improving efficiency and accuracy. Some common systems include:

- Customer Relationship Management (CRM) Systems: Sync customer data for better service.

- Enterprise Resource Planning (ERP) Systems: Integrate accounting with supply chain and inventory.

- Payroll Systems: Ensure accurate and timely payroll processing.

- Banking Systems: Automate bank reconciliations and financial reporting.

Integration with these systems reduces manual data entry. It also minimizes errors and saves time.

Extending Functionality Through Add-ons

Non cloud-based accounting software can be extended through various add-ons. These add-ons provide additional features and functionalities. Some popular add-ons include:

- Tax Calculation Modules: Automate tax calculations and compliance.

- Invoicing Tools: Create and manage invoices easily.

- Financial Reporting Tools: Generate detailed financial reports.

- Inventory Management Add-ons: Track inventory levels and manage stock efficiently.

Using these add-ons makes the software more versatile. Businesses can tailor the software to meet their specific needs.

| Add-on | Functionality |

|---|---|

| Tax Calculation Modules | Automate tax calculations and ensure compliance |

| Invoicing Tools | Create and manage invoices easily |

| Financial Reporting Tools | Generate detailed financial reports |

| Inventory Management Add-ons | Track inventory levels and manage stock |

Integrating with other systems and using add-ons greatly enhances the capabilities of non cloud-based accounting software. It provides a more comprehensive and efficient solution for businesses.

Credit: alloysilverstein.com

User Perspectives And Reviews

Non cloud based accounting software continues to gain popularity. Users appreciate its reliability, security, and ease of use. In this section, we explore various user perspectives and reviews. Hear from small businesses and accounting professionals who rely on this software.

Testimonials From Small Businesses

Many small businesses prefer non cloud based accounting software. They value the control and cost-effectiveness it offers. Here are some testimonials:

- John’s Bakery: “We love our accounting software. It helps us track sales and expenses without an internet connection. It’s simple and reliable.”

- Linda’s Boutique: “Our accounting software fits our needs perfectly. It’s secure and easy to use. Plus, no monthly fees!”

- Mike’s Auto Repair: “This software keeps our finances in order. We don’t worry about data breaches. It’s a great investment for our small business.”

Feedback From Accounting Professionals

Accounting professionals also share positive feedback. They find non cloud based software efficient and user-friendly. Let’s look at their insights:

- Sarah, CPA: “I recommend this software to my clients. It’s straightforward and secure. It works well for businesses of all sizes.”

- Tom, Accountant: “The software simplifies my work. I can manage multiple clients without internet issues. It’s a reliable tool for any accountant.”

- Emily, Financial Advisor: “My clients feel safe using non cloud based accounting software. They appreciate the privacy and control it provides.”

The Future Of Accounting Software

The future of accounting software is an exciting topic. Technology keeps evolving, and so does accounting software. Non-cloud-based solutions are getting smarter and more efficient. Let’s dive into what the future holds for these systems.

Emerging Trends

Non-cloud accounting software is seeing many new trends. These trends are shaping the future of accounting.

- AI and Machine Learning: These technologies are automating more tasks. AI helps in error detection and data entry.

- Enhanced Security: Non-cloud solutions are improving their security features. This keeps sensitive financial data safe from cyber threats.

- Integration Capabilities: These systems now integrate better with other software. This includes CRM, ERP, and more.

- User-Friendly Interfaces: Modern non-cloud software is easier to use. It has intuitive designs that even beginners can navigate.

Predictions For Non-cloud Solutions

Experts have some exciting predictions for non-cloud accounting software. These will make accounting even more efficient.

- More Automation: Expect more tasks to be automated. This will save time and reduce errors.

- Better Analytics: Non-cloud software will offer better data analytics. This helps in making informed business decisions.

- Increased Customization: Future software will be highly customizable. Businesses can tailor it to their specific needs.

- Offline Access: Non-cloud solutions will improve offline capabilities. Users can work without an internet connection.

These predictions show a bright future for non-cloud accounting software.

Making The Right Choice

Selecting the perfect non-cloud based accounting software is crucial. Your business needs may vary, and it’s essential to find the right fit. This section will guide you through the process of making an informed decision.

Assessing Business Needs

First, identify your business requirements. Consider the size of your business. Small businesses have different needs than large enterprises. Think about the features you need:

- Invoicing

- Expense Tracking

- Payroll Management

- Financial Reporting

Make a list of essential features. Prioritize them based on importance. Ask your team for input. They can provide valuable insights. Understanding your needs helps in making the right choice.

Selecting The Ideal Software

Now, review available options. Research different non-cloud based accounting software. Compare their features. Here is a simple comparison table:

| Software | Key Features | Price |

|---|---|---|

| Software A | Invoicing, Expense Tracking | $200/year |

| Software B | Payroll Management, Financial Reporting | $300/year |

| Software C | All Features | $500/year |

Check user reviews and testimonials. They provide real-world insights. Evaluate the ease of use. A user-friendly interface saves time and reduces errors. Consider the cost. Ensure it fits your budget without compromising on features. Test the software with a demo or trial version. This helps you understand its functionality before making a commitment.

By following these steps, you can make an informed decision. Your business will benefit from the right non-cloud based accounting software.

Credit: www.zarmoney.com

Frequently Asked Questions

What Is Non-cloud Based Accounting Software?

Non-cloud based accounting software is installed on local computers. It doesn’t require internet access. Data is stored on local servers. This offers more control over data security.

Why Choose Non-cloud Based Accounting Software?

Non-cloud based accounting software offers more control over data. It doesn’t depend on internet access. This can be crucial for businesses with security concerns.

Is Non-cloud Based Accounting Software Secure?

Yes, non-cloud based accounting software is secure. Data is stored locally, reducing the risk of online breaches. Users have full control over their security measures.

Can Non-cloud Based Accounting Software Work Offline?

Yes, non-cloud based accounting software works offline. It doesn’t require an internet connection. This is beneficial for businesses in areas with unreliable internet.

Conclusion

Choosing non cloud based accounting software offers control and security. It suits businesses needing offline access and data privacy. Evaluate your needs to find the right fit. This software can streamline your financial processes efficiently. Make an informed decision to enhance your accounting workflow.